We collaborate with Financial Advisors across various industries.

Take your advisory services to the next level with our powerful automated rebalance software.

Effortlessly scale rebalancing, tax-loss harvesting, and direct index accounts with our versatile API driven solution.

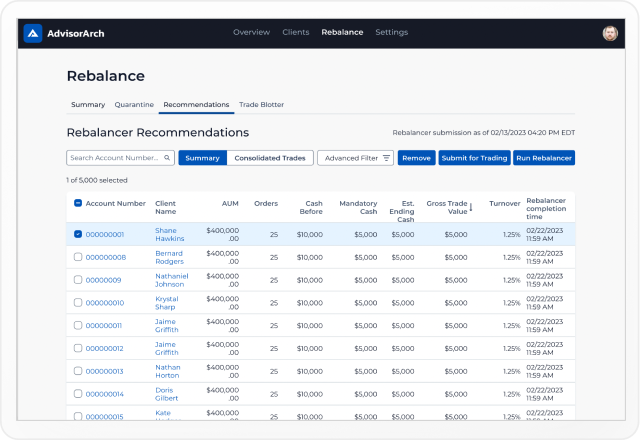

Rebalance your clients’ portfolios and enable client specific customization at scale with our powerful API-driven solution.

Build custom models or import third-party solutions, trade fractional/whole shares, and implement asset location preferences.

Simplify goal-based account assignment using our interface or APIs, including automated glide path and risk score options.

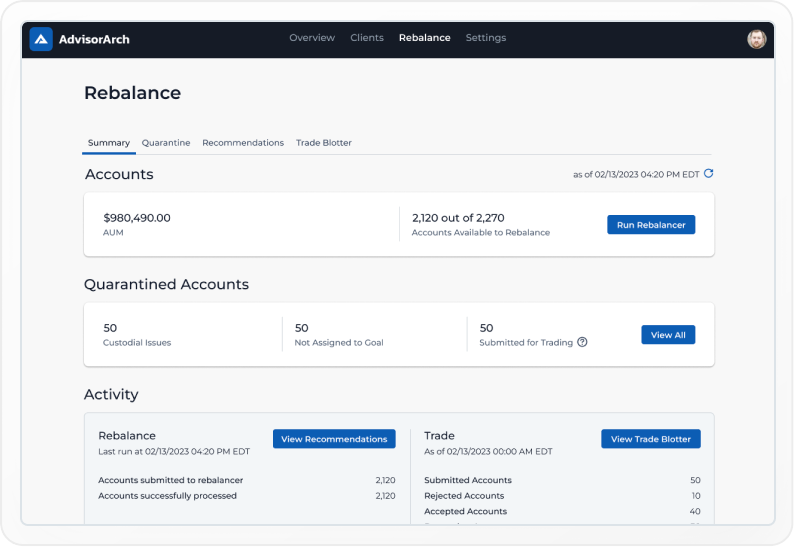

Using real-time rebalancing and OMS, monitor accounts, track trades, and gain insights through detailed explanations for recommended trades.

Maximize tax efficiency and incorporate intelligent tax-loss harvesting capabilities to optimize investment returns while minimizing tax liabilities.

Enhance investment strategies using direct indexing, enabling customized firm and client indices, ESG overlays, and advanced tax-loss harvesting.

Access intuitive back-office dashboards to build investment solutions for your clients and APIs tailored to fit the needs of your practice.

Customize tax and rebalancing settings, view asset allocation at the client, goal, and account level.

Available with customizable permissions and options to ensure consistency across your entire book of business.

Effortlessly rebalance portfolios with our seamless integration with Apex Fintech Solutions.

Seamlessly integrated with diverse custodians through our strategic partnership with Assetbook

Our executive team boasts over 35 years of combined experience in the investment and advisor industries. With their extensive knowledge and expertise, our team is dedicated to driving innovation in the industry and delivering exceptional solutions to our clients.

Take your advisory services to the next level with our powerful automated rebalance software.

© 2023 AdvisorArch

We ensure complete confidentiality of your information.

Ed is Chief Technology Officer and Co-Founder of AdvisorArch. Prior to AdvisorArch, he was Vice President of Engineering at RobustWealth and was responsible for the growth and development of RobustWealth’s technology strategy.

Ed has 30 years of technology experience including 18 years as a director and Bloomberg LP, a leading financial data and analysis platform. He holds an MS from Temple University and a BA from Rutgers University where he graduated with honors.

Rob is the Founder & Co-Chief Executive Officer of AdvisorArch. Prior to AdvisorArch, he was the Chief Investment Officer at RobustWealth and was responsible for the development and implementation of RobustWealth’s investment strategy.

Rob has 25 years of investment experience including 16 years as a managing director for the CooperNeff Group, a multi-strategy alternatives company. During his tenure at CooperNeff, Rob was responsible for a global multi-billion dollar process trading operation that was comprised of a staff of 50 professionals. He holds an MBA from Wharton where he graduated with honors. Rob also served on the board of Archipelago, an electronic trading platform that was subsequently acquired by the New York Stock Exchange.

Mike Kerins is the Co-Chief Executive Officer and co-founder of AdvisorArch. Prior to AdvisorArch, Mike founded RobustWealth in 2015. Principal Financial Group acquired RobustWealth in 2018 and Mike was CEO of RobustWealth until 2021. Mike spent eight years at Franklin Templeton, where he managed an investment team overseeing a global portfolio of assets equaling $40 billion. He also served as the head of asset class research and has expertise spanning strategic and tactical asset allocation, portfolio construction, target date strategies and liquid alternatives.

Mike is a CFA® charter holder as well as a certified Financial Risk Manager. He holds a B.S. in Finance and a B.S. in Chemical Engineering from the University of Colorado and has a certificate in Computational Finance from the University of Washington.